[Volume 21. Recursion Pharmaceuticals: Revolutionizing Drug Discovery with 65 Petabytes of Data and AI]

- Paul

- Sep 26, 2025

- 6 min read

Recursion Pharmaceuticals Overview

Founded: 2013

Headquarters: Salt Lake City, Utah

Website: https://www.recursion.com

Core Services: AI-powered drug discovery and development platform

Listed: NASDAQ (RXRX)

2024 Revenue: $15 million (Q1 basis)

Employees: Approximately 600 (post-Exscientia merger)

Cash Holdings: $603 million (end of 2024)

Recursion Pharmaceuticals is a TechBio company that leverages data and AI to bring better medicines to patients faster by decoding biology.

Core Technical Differentiation

1. Recursion OS - Integrated AI Platform

Recursion's greatest technical differentiator is the

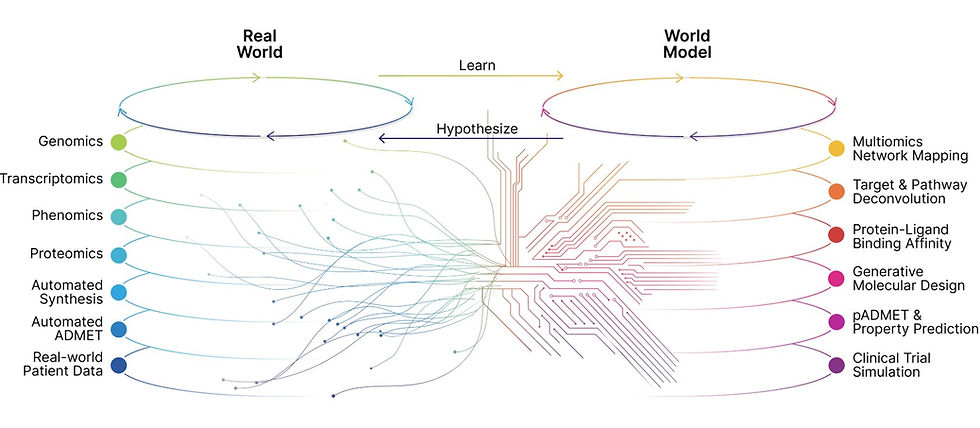

Recursion Operating System (OS). This next-generation biotech drug discovery and development platform trains machine learning models using 65 petabytes of purpose-built data to identify promising new targets and design highly optimized molecules.

2. World's Largest Biological Dataset

Over the past decade, Recursion has built one of the world's largest purpose-built proprietary biological and chemical datasets. The 65 petabytes of data span phenomics, transcriptomics, InVivomics, proteomics, ADME, and de-identified patient data.

3. BioHive-2 Supercomputer

In May 2024, Recursion announced BioHive-2, the pharmaceutical industry's largest supercomputer, built in partnership with NVIDIA. BioHive-2 ranks as the 54th most powerful supercomputer on the 2024 Top 500 list.

4. High-Throughput Automation System

The automated wet lab utilizes robotics and computer vision to capture millions of cell experiments per week, enabling the testing of up to 2.2 million samples per week through automation.

Competitive Differentiation Analysis

Competitor Comparison

Company | Core Technology | Key Strengths | Limitations |

Recursion Pharmaceuticals | Sensor-AI fusion platform | 65PB proprietary dataset, complete integrated platform, real-world validated automation | Relatively conservative adoption of new technologies |

DeepMind (AlphaFold) | Protein structure prediction | Revolutionary protein folding prediction, strong AI research capabilities | Limited to drug discovery, restricted commercial application |

Atomwise | AI-based molecular design | Virtual screening expertise, rapid compound identification | Lack of experimental validation capabilities, limited data scale |

BenevolentAI | Knowledge graph-based AI | Literature and data integration, existing drug repurposing | Limited new target discovery, lack of laboratory automation |

Recursion Pharmaceuticals' Unique Approach

Unlike traditional drug discovery that starts with specific targets or hypotheses, Recursion leverages the Recursion OS. This integrated platform uses automated experiments with multi-omic and chemical data to discover novel drug targets and potential mechanisms of action.

Major Partnerships and Collaborations

1. NVIDIA Strategic Partnership

In 2023, Recursion Pharmaceuticals entered into a strategic partnership with NVIDIA, backed by a $50 million investment, aimed at advancing its AI-enabled drug discovery mission.

2. Google Cloud Expanded Partnership

In October 2024, Recursion Pharmaceuticals and Google Cloud announced an expanded collaboration to explore generative AI capabilities, including Gemini models, to support RecursionOS, drive improved search and access with BigQuery, and help scale compute resources.

3. Major Pharmaceutical Partnerships

Roche & Genentech: Collaboration to discover and develop treatments for up to 40 programs in neuroscience and gastrointestinal oncology. Recently triggered a $30 million payment for the first optioned neuroscience phenomap.

Bayer: $1.5 billion partnership focusing on 'undruggable' oncology targets, with the first project already selected.

Sanofi & Merck KGaA: Generating revenue due to project timing from existing Sanofi, Roche, and Merck KGaA collaborations.

4. Exscientia Acquisition Integration

In November 2024, the business combination of two AI-powered drug discovery and development companies, Recursion Pharmaceuticals and Exscientia, was completed. Exscientia became a wholly owned subsidiary of Recursion Pharmaceuticals, creating a vertically integrated technology-enabled drug discovery platform.

Investor Perspective and Stock Analysis

Current Market Performance

Recursion Pharmaceuticals (RXRX) has experienced significant share price volatility in 2025, dropping 27% year-to-date and trading over 55% below its 52-week high of $12.

Analyst Ratings and Price Targets

Ten analysts have given Recursion Pharmaceuticals a "Buy" consensus rating, with an average price target of $7.00, representing a 25.90% increase from the current stock price. Price targets range from a low of $5.00 to a high of $10.00.

Valuation

According to Morningstar, RXRX is currently trading at a 500% premium, indicating an overvalued state.

Risk Factor Analysis

1. Clinical Trial and Regulatory Approval Risks

Challenges inherent in pharmaceutical research and development include the timing and results of preclinical and clinical programs, where the risk of failure is high and failure can occur at any stage prior to or after regulatory approval due to lack of sufficient efficacy, safety considerations, or other factors.

2. Technology Validation Risk

While Recursion's AI-powered platform is promising, its effectiveness compared to traditional drug discovery methods still needs full validation in clinical settings. The platform's ultimate success hinges on its ability to identify successful drug candidates more efficiently.

3. Financial Sustainability Risk

Given its current cash burn, Recursion will likely require additional funding, potentially leading to shareholder dilution or increased debt. The Q2 2025 net loss reached $171.9 million (-$0.41 per share).

4. Competitive Risk

Competitors like Insilico Medicine, BenevolentAI, and Generate Biomedicines are also pursuing AI-driven approaches, intensifying competition. The biotech sector is highly competitive, with many drugs failing before seeing a return on investment.

Market Competition Environment and Opportunities

AI Drug Discovery Market Size

As of June 2023, more than $18 billion had poured into some 200 "AI-first" biotechs, and by January 2024, at least 75 drugs or vaccines from those companies had entered clinical trials. The global AI drug discovery market, valued at $1.1 billion in 2022, is projected to grow at a 29.6% CAGR through 2030.

Competitive Landscape

Major competitors include Owkin, BenevolentAI, Insilico Medicine, Valo Health, Atomwise, DeepMind, Exscientia, and Healx. Some of these companies are already advancing candidates into Phase 2 trials, intensifying the race to market.

Technical Details and Innovation

ClinTech Platform

Recursion has begun a "ClinTech" effort that applies AI beyond drug design and discovery toward clinical trials approaches. This focuses on three key areas: smarter trial design, accelerating enrollment, and enhancing evidence generation.

Development Speed Innovation

Recursion was able to use its AI-enabled drug discovery platform to identify a novel target and move to IND approval in less than 18 months, more than twice the speed of the industry average of 42 months.

Open Source Initiatives

Recursion is actively investing in open-sourcing its data and models, making Phenom-Beta and RXRX3 databases publicly available.

Financial Status and Market Outlook

Financial Stability

As of December 31, 2024, cash, cash equivalents, and restricted cash were $603.0 million, with Q2 2025 cash holdings of $533.8 million, providing a cash runway through Q4 2027 based on current business plan.

Debt Ratio: With minimal debt at $93 million, the debt-to-equity ratio is 4.4%, significantly outperforming the S&P 500 average of 19.4%, showing a very healthy financial structure.

Cost Optimization Strategy

In May 2025, the company announced discontinuation of three of its most advanced drug programs as part of cost reduction efforts following the merger. Expected cash burn excluding partnering or financing inflows for 2025 is equal to or less than $450 million.

Market Opportunity

The AI-driven drug discovery market is expected to grow from $0.9 billion in 2023 to $4.9 billion by 2028, at a projected compound annual growth rate (CAGR) of 40.2%.

Clinical Pipeline Status

Current Pipeline

The combined pipeline represents more than 10 clinical and preclinical programs. Additionally, there are approximately 10 advanced discovery programs in the current pipeline.

Key Programs

REC-617 (CDK7 inhibitor): For advanced solid tumors with initial Phase 1 monotherapy safety and PK/PD data expected.

REC-1245 (RBM39 degrader): A potential first-in-class RBM39 degrader for biomarker-enriched solid tumors and lymphoma.

REC-3565 (MALT1 inhibitor): For B-cell malignancies, differentiated from other MALT1 inhibitors in clinical development through its ability to avoid UGT1A1 inhibition.

Future Strategy and Roadmap

Key Milestones 2025-2026

At least seven programs are expected to begin human trials or read out clinical data during 2025. Key schedules include REC-4881's Phase 1b/2 safety and early efficacy data (H1 2025), and REC-1245's Phase 1 dose-escalation data update (H1 2026).

Platform Expansion Plans

The value of Recursion OS extends beyond the company's internal drug development efforts. It could be licensed to other pharmaceutical companies, generating additional revenue streams and validating the platform's commercial viability.

Conclusion: Leader in AI-Integrated Drug Discovery

Recursion Pharmaceuticals' true value lies not in AI technology development but in its system integration capability that connects existing top-tier AI systems with sensors in real operational environments and immediately translates them into action.

Core Differentiation Factors

Technical Differentiation: Complete automation loop from sensors → AI → action, situation-specific optimal utilization of multiple AI models, 10 years of proven system integration expertise

Market Position: Proven reliability in government and private sectors, the only large-scale platform connecting AI with the real world, practical AI solutions expanding to private sector

Data Analytics Developer Perspective: If traditional data analysis is "processing historical data," Recursion Pharmaceuticals' system represents "instantly converting real-time sensor data into action." This is an innovation that completely changes the dimension of data analysis.

Recursion Pharmaceuticals positions itself beyond a simple technology company in the AI-driven drug discovery field, establishing itself as an integrated platform that solves biological complexity and is evaluated as a key company that will lead the convergence of AI and life sciences in the future.

© 2025 The intellectual property rights of this report belong to the author and respective companies.

![[Volume 33. Manus: The Autonomous Agent That Beat Foundation Models]](https://static.wixstatic.com/media/de513c_096862c6ad454814881ce6711778b39c~mv2.png/v1/fill/w_980,h_444,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/de513c_096862c6ad454814881ce6711778b39c~mv2.png)

Comments